The Truth About Prank Payments: Here’s What You Need to Know

If you’ve ever encountered the term “prank payment,” you’re probably curious about what it really means. Is it just harmless fun, or does it come with serious risks?

As someone who’s been following and experiencing trends like this, I’m here to break it down for you. Let’s dive into the world of prank payments and separate fact from fiction.

What Is a Prank Payment?

A prank payment is exactly what it sounds like—a joke involving fake or misleading payment transactions. Typically, this involves sending someone a false notification or screenshot that appears to confirm a payment. While it might seem amusing to the sender, it’s not as innocent as it appears. These pranks often happen during casual online sales, money exchanges, or even within friend groups.

Common Types of Prank Payments

From my experience, prank payments usually fall into these categories:

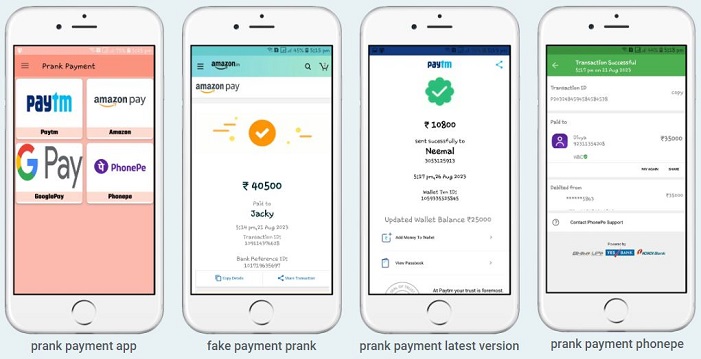

- Fake Screenshots: People use apps or online tools to generate fake payment confirmation screens. These are then sent to unsuspecting individuals as “proof” of payment.

- Spoofed Payment Notifications: Some pranksters go a step further by sending spoofed emails or texts that mimic payment platform notifications.

- Reversible Transactions: Using platforms where payments can be reversed (like PayPal or Venmo), some people send money and then quickly cancel the transaction—leaving the recipient in the lurch.

Why Prank Payments Are Not Just “Harmless Fun”

While the idea of fooling someone might seem harmless, prank payments can have real consequences:

- Financial Loss: For businesses and sellers, prank payments can disrupt operations and lead to financial loss.

- Trust Issues: These pranks can erode trust between friends, family, or business partners. No one likes feeling tricked!

- Legal Consequences: Depending on the situation, prank payments could be considered fraudulent activity, leading to legal repercussions.

My Personal Experience with Prank Payments

Let me tell you about a prank payment I encountered. A friend jokingly sent me a fake screenshot of a payment they claimed to have made for concert tickets I was selling. At first, I was confused because my payment app showed no such transaction.

When I confronted them, they laughed and revealed it was a prank. While I knew this friend well enough to laugh it off, I realized how easily someone else could have fallen for it.

This incident taught me to be extra vigilant—and now, I always double-check transactions directly on payment platforms before handing over goods or services.

How to Protect Yourself from Prank Payments

Here are a few tips I’ve learned to avoid falling victim to prank payments:

- Always Verify Payments: Double-check with your payment app or bank to confirm the transaction before delivering goods or services.

- Beware of Screenshots: Never rely solely on screenshots as proof of payment. They’re easy to fake.

- Stick to Trusted Platforms: Use reliable payment platforms that notify you in real-time and have fraud protection features.

- Educate Others: If you’re selling something online, let your buyers know you’ll verify payments first to avoid confusion.

Final Thoughts

Prank payments may seem like harmless fun, but they can cause a lot of unnecessary stress and damage. Whether you’re buying, selling, or just sharing money with friends, always take steps to protect yourself.

And if you’re the one tempted to pull this kind of prank—think twice. The consequences might not be worth the laughs.